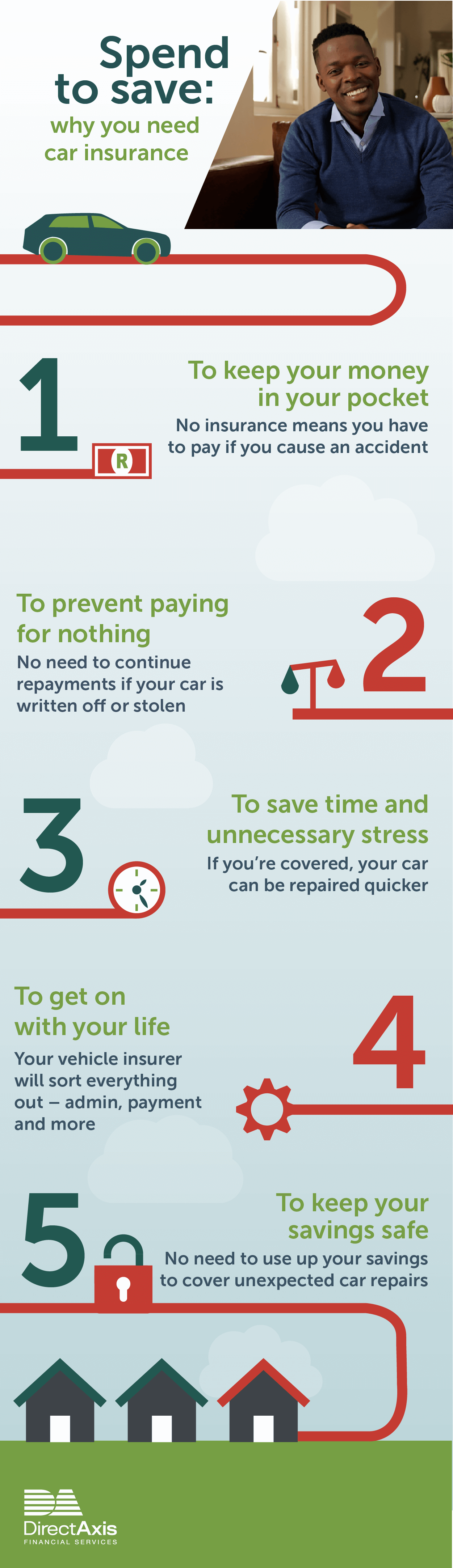

Paying car insurance can actually save you money. Yes, save! It may seem expensive, but if you look at the reasons below, it's well worth spending the extra cash every month.

1. To keep your money in your pocket

Car repairs are costly. If you don’t have car insurance, and you cause an accident, you will have to pay for repairs to fix yours and the other person’s car.

2. To prevent paying for nothing

Imagine your car is written off or worse, stolen, while you’re still busy paying it off. If you don’t have car insurance, you will need to continue paying it off even if you’re not actually driving it. That’s really throwing money away.

3. To save time and unnecessary stress

Claiming and getting a payout from insurers is pretty straightforward these days. That means if you’re covered, your car can be repaired straight away instead of having to save before settling the panel beater’s bill. And just think of all the extra bus and taxi fares you’re saving.

4. To get on with your life

If you’re involved in a car accident with someone else, and it is clearly your fault, you need to pay. If you have vehicle insurance, your insurer will sort everything out – admin, payment and more. That means you can relax and just get on with your life.

5. To keep your savings safe

Accidents happen at the worst times. About to put down a deposit for your wedding? If you’re involved in a car crash, and you don’t have car insurance, you might have to downgrade from a banquet to a braai.

So that’s a yes for car insurance. Spend a little money every month to save a lot over the long run.

The first step to your first set of wheels? Check your credit rating with DirectAxis Pulse.